Image Source: Lexica

Introducing the InvestIt Now Substack

Your Source for Simple yet Sophisticated Investment Strategies

Welcome to the InvestIt Now Substack newsletter! We are thrilled to introduce our new platform where we will be sharing long-term investment signals based on our proprietary, simple yet sophisticated strategies. In this article, we will dive deep into one of our strategies called In and Out, which aims to guide investors through bull and bear markets. Let's explore the benefits of our newsletter and how you can subscribe to stay ahead in your investment journey.

What is a Simple yet Sophisticated Strategy?

A simple yet sophisticated strategy is one that combines ease of understanding and implementation with rigorous quantitative analysis. At InvestIt Now, we believe in providing strategies that are accessible to all investors while backed by robust research. Our In and Out strategy is a prime example of this approach. The core idea behind this strategy is to divide the market into two regimes: bull and bear markets. By identifying these regimes and adjusting your portfolio accordingly, you can potentially maximize returns and reduce risk.

The In and Out Strategy: Navigating Bull and Bear Markets

Understanding the In and Out Strategy

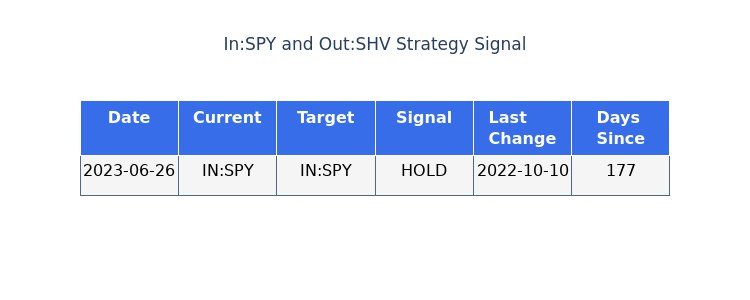

The In and Out strategy revolves around two key investment options: the S&P 500 index (SPY) for “bull” markets and a Treasury bill ETF (SHV) for “bear” markets. The terms bull/bear, in this case, means a period during which the market returns are generally rising/failing. The strategy recommends allocating your investments to the S&P 500 index, which historically has displayed strong performance during such market conditions. On the other hand, during bear markets, the strategy advises shifting your investments to a Treasury bill ETF, providing a safer haven for your capital.

Image Source: @InvestItNow Telegram

Backtesting and Quantitative Analysis

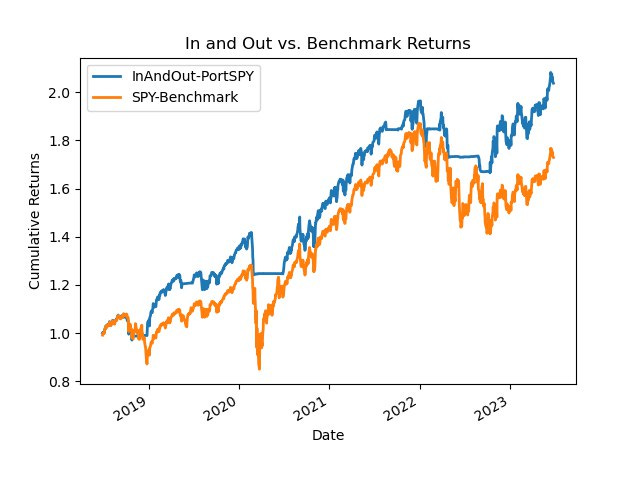

At InvestIt Now, we take the performance of our strategies seriously. The In and Out strategy has undergone rigorous backtesting and quantitative analysis using historical market data. Our research indicates that this strategy has consistently generated positive returns over time while effectively managing volatility and drawdown. Drawdown, which represents the percentage of a fund's value lost from its peak, is an important metric we consider to ensure risk mitigation for our users. In the past 5 years, our model shows a cumulative returns improvement of 23% over S&P 500 (SPY) cumulative returns.

For a comprehensive history of this method, we wrote two articles about a previous version of the strategy. See 1,2

Using backtesting and past history data, that is coupled with research done on market signals, a computer program is used to analyze many variables into a macro trading signal that is delivered to you.

Benefits of the InvestIt Now Substack Newsletter

Subscribing to the InvestIt Now Substack newsletter offers a range of benefits to investors like you. Here's what you can expect:

Access to Proprietary Strategies on Multiple Platforms

Image Source: @InvestItNow Telegram Channel

Our newsletter provides you with exclusive access to our proprietary investment strategies. You can find these strategies right here on the Substack platform, as well as on our Telegram channel and Twitter. We aim to make our strategies easily accessible to you, regardless of your preferred platform.

Regular Educational Updates

Investing can be a complex field, and we believe in empowering our subscribers with knowledge. Our newsletter will regularly feature educational updates on personal finance and investing. Stay informed about the latest trends, concepts, and techniques to make sound investment decisions.

Community Interaction and Support

We value community engagement and interaction. By subscribing to our newsletter, you gain access to our vibrant community. Engage in discussions, ask questions, and share insights with fellow investors in our comments section, chats, and live sessions. We are committed to creating a supportive environment where you can learn and grow.

How to Subscribe to the InvestIt Now Substack Newsletter

Subscribing to the InvestIt Now Substack newsletter is quick and easy. Simply follow the steps below:

Click on the link provided at the end of this article.

You will be redirected to our Substack page.

Enter your email address in the subscription box.

Click on the "Subscribe" button.

That's it! You are now part of the InvestIt Now community, ready to receive our valuable investment signals and educational content.

Join Us on Telegram and Explore More Opportunities

Image Source: @InvestitNow Telegram channel

If you haven't already viewed our telegram channel, we invite you to click:

By doing so, you will view our active signals, quantitative analysis, and more. We are dedicated to keeping you informed about the ever-changing investment landscape.

To be able to get real-time updates when the Telegram channel signal changes, along with being able to comment on the Telegram posts, you can subscribe to the channel by clicking the link below.

Conclusion: Your Journey Starts Here

Investing wisely requires the right strategies and insights. At InvestIt Now, we are committed to providing you with simple yet sophisticated investment strategies. Our In and Out strategy is just the beginning of our journey together. Subscribe to our Substack newsletter for free and unlock a wealth of information that will help you make informed investment decisions.

Thank you for choosing InvestIt Now! We look forward to accompanying you on your investment journey.

Sincerely,

The InvestIt Now team (Alan & Jeff Coppola)P.S. For more information on future plans for InvestIt Now see our website investitnow.co

Remember, investing involves risk, and past performance is not indicative of future results. Please consult with a financial advisor before making any investment decisions. None of the information we present to you is personal investment advice.