InvestItNow | About

InvestIt Now Signals Newsletter - Volume 1 Number 5 - Journey with us on your Sophisticated yet Simple Investment travels.

Why Use InvestItNow.co: A Journey from Quant to Real-World Investing

Several years ago my brother and I (Alan & Jeff Coppola) embarked on a mission to use quantitative computing and try to make some sense of the stock market and even make some money. Together we have a math and engineering background and have professional experience in computing, math and engineering.

A company/startup called Quantopian was looking for programmers with interest in finance and the stock market.

Breaking News: Quantopian Newsletter is back! Click here to subscribe.

The idea was to create a large body of programmers and let them come up with the best methods to utilize math and programming skills to “beat” the stock market. Things went along nicely for awhile. Quantopian provided support and cloud based computing using their open source Zipline backtester and free cloud-based compute and dashboards.

Contests were run to determine the best Profit and Loss coupled with other factors such as Volatility, Sharpe Ratio and Down Draft. The winner would be funded to run real-time stock market trades. We made the top ten a number of times in their contests, even to the point of going through the funding process, before they changed their management and criteria.

Over time it became apparent that Quantopian’s ideas were not going to work in the real trading world. Contest requirements became tougher and programmers started to drop out and contests got smaller. Eventually Quantopian had to shut down but their Zipline still is available today as open source, of which, we use the zipline-reloaded version, along with a number side quant analysis tools.

So where is this all going?

We saw after several years of work two things:

Monetizing Quant Tools is Tough: Supplying quant tools, based on zipline, to customers like those of Quantopian was too hard to monetize, as those customers preferred to build their own rather than pay for them.

Beating Benchmarks is a Fool's Errand: Actually doing better than benchmarks in the stock market (like the S&P 500) was a fools errand. High Frequency traders, Hedge funds, and larger brokerage houses always have the upper hand in information and capital.

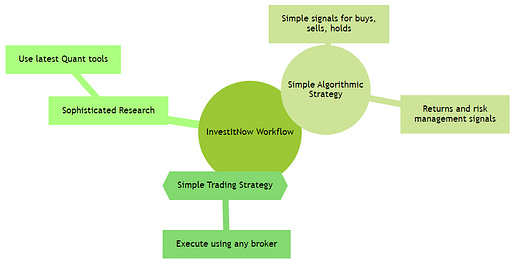

What did we do? We decided to utilize our sophisticated tools like zipline-reloaded to create algorithms that are simple to understand but effective in execution.

So what can the average Joe do?

As Warren Buffet said, Invest in the S&P 500 index and forget about it until retirement. Another version of that is illustrated in this recent article illustrating that rebalancing your portfolio to let the winners run, cut the losers, and buy low with extra cash. Finally, there was a cognizant forum thread on Quantopian whose principle was to invest simply, like the first article in this series about the In and Out algorithm does.

That’s where InvestItNow.co comes into play. By building on what we learned while programming for Quantopian, we developed a pipeline for simple investment programs that are created with sophisticated cutting-edge quantitative toolsets. Stay tuned on this channel for more algos that are easy to execute and understand.

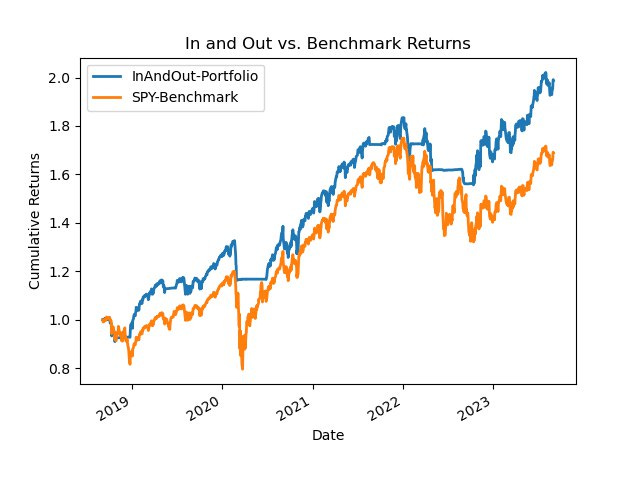

The first one, In and Out, will beat the S&P500 benchmark over the years. The key is to avoid large drawdowns that happen every once in awhile in the stock market.

Why Limiting Losses Matters

Remember, if a stock goes down 50% it takes a 100% move to break even.

Think about if you could limit the downdraft to 25% for example. You would only need 33% up move to break even. This is very important to limit losses and start from a higher base when the market turns up.

So using some stock market data and a macro trend idea we developed, the In and Out algorithm computes a signal when a big down draft is occurring, and tells you when to get Out. We use our quant tools (e.g. Zipline) to generate our signal. Our signal is on telegram which you can click here Telegram InvestIt Now Channel to view.

Execution: Simplicity is Key

Do you have to trade a lot?

No, You are either “IN” the ETF SPY or “OUT” in the ETF SHV or cash equivalent. By avoiding any large downdrafts your investment grows larger over the long term, assuming the investment thesis that the market index S&P 500 rises steadily over time.

While people say you can't time the market, we consider this method of timing as a risk-management device to limit losses while providing a clear signal of when to get back in the market.

In case you are wondering, our method would never meet the Quantopian contest requirements but we embarked on this because it works with minimal effort so you can do other things in your life.

Execution: Simplicity is Key

Our algorithm generates a signal, which you can find on our Telegram channel, that tells you when to get "Out" of the market. The beauty? You only have to trade between two ETFs: SPY and SHV. You're either "IN" or "OUT," making it incredibly straightforward and low-maintenance.

What's Next?

Stay tuned for more algorithms that are easy to execute and understand. We're planning to roll out some new simple yet sophisticated strategies for your portfolio. Watch also for our app, with an AI copilot to guide you.

We Want to Hear From You!

Your feedback is invaluable to us. Got topics you want us to cover or questions about our strategies? Shoot them our way.

That's all for now! Here's to making smarter investment decisions without breaking a sweat.

Cheers, Jeff & Alan