In and Out | Status - IN again, yet stay OUT !

InvestIt Now Signals Newsletter - Volume 2 Number 4 -Status and Heat - October 24, 2024

TLDR

The InAndOut Heat Signal is IN after a month of being Out!

We recommend still being OUT (we are), due to the extrinsic risk factors:

2024 Presidential Election - high volatility + potential for lawfare post election

VIX Level is higher than last year (19.58)

Shiller PE Ratio (CAPE) is historically high (34.48)

Warren Buffet’s actions indicate reduced market exposure.1

What kind of strategy is this that you won’t obey the signal ?

The IN signal occurring so soon after the OUT signal warrants human review for special conditions, essentially relating to extrinsic risk, which this simple signal was not designed to capture. Due to the long term nature of this strategy, a month or more of not following the signal should not affect the end result much

When volatility is high, across multiple measures, we’ve decided to delay acting on the defining signal until the cross-modal volatility decreases. Here are our reasons:

Election Instability and VIX 2

In the upcoming US presidential election between Donald Trump and Kamala Harris, without either being the current incumbent, there is a tendency to exhibit even higher volatility due to investor anxiety surrounding potential policy changes. There is also a risk of lawfare, by either loser, delaying the results and increasing instability in our institutions.

Election years tend to increase market volatility, as evidenced by historical VIX trends.

Note that the current VIX level, while indicating moderate uncertainty, is higher than the previous year.

Warren Buffett's Warning

Warren Buffett is a legendary investor whose actions provide valuable insights.

Buffett's unprecedented net-selling of equities for seven consecutive quarters, totaling $132 billion indicates caution and readiness for ‘buying the dip’.

His selling activity suggests a cautious stance, likely due to the high valuation of the stock market.

Shiller P/E Ratio

The Shiller P/E ratio (CAPE ratio) is a measure of stock market valuation, the cyclically adjusted price-to-earnings ratio, or Cape ratio

It is at a current very high level, which has historically has preceded market downturns.3

Post-Election Outlook

There is history for potential market stabilization after the election as uncertainties resolve. [5, 7]

InvestItNow will reassess the situation after the election and provide updated guidance.

Appendix: Stats and Charts for current state of InAndOut Strategy

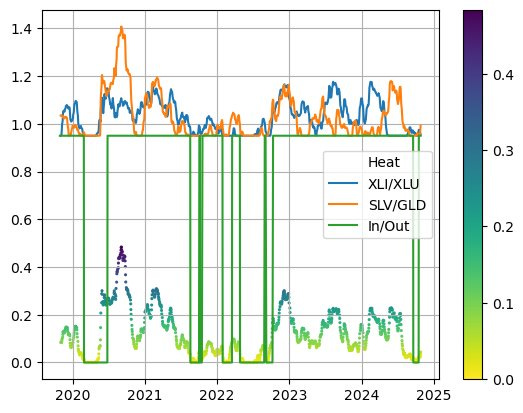

Here is the current 50 day graph of the component signals, from Telegram. When the signals simultaneously fall below the 0.95 threshold, that is the Out signal, and the portfolio, be it SPY or 75% SPY + 25% BTC goes to a risk-free ETF, like SHV or cash.

Here is today’s signal:

Here are the updated detailed heat graphs. Heat is a measure that tells you how close to being OUT the strategy is.

Review Results

Using equity SPY with strategy: InandOut

during Period: [2019-10-24, 2024-10-18]

Cum Returns:126%

CAGR:18%

Max Drawdown:-13%

Returns by period: 3m:4% 6m:15% 1yr:35% 3yr:15% 5yr:18%

Risk measures:Monthly

Sharpe:1.3 Mean:17.0% Volatility:13.2%

You can access this data at the Telegram link: InvestIt Now Channel

The Future

We expect to review our current InAndOut signal, for possible enhancement by incorporating VIX and CAPE information, along with sentiment information that reacts to major current events (like elections and wars).

We are also expecting to add other long-term investment portfolios, using the same InAndOut signal, as a global gating signal, yet incorporating other strategy types, like Direct Cost Averaging(DCA), Fundamentals for stocks and and ETFs, and other standard strategies, like Momentum, Carry and Mean Reversion ones

Disclaimer

This is not financial advice, and readers should consult with a financial professional before making investment decisions.

For access to much more detailed data about this and other strategies, subscribe to our Substack here:

https://www.fool.com/investing/2024/08/06/warren-buffett-132-billion-warning-to-wall-street/

https://www.perplexity.ai/page/vix-and-market-stability-y75CA.2XRfKo3wYLwqH9pA

From [1] “Including the present, there have only been a half-dozen occasions in more than 150 years where the Shiller P/E ratio has topped 30 during a bull market. The previous five instances were all followed by plunges of 20% to 89% for Wall Street's major stock indexes.”